Tariff Policy

To fulfil the mission of ensuring the NPG reliable operation, KEGOC has the main income source — cap tariffs for regulated services, which are approved by the authorized body for natural monopolies.

When implementing the large infrastructure investment projects, the company adheres to the tariff gradual increase policy. Under the Law on Natural Monopolies of the Republic of Kazakhstan the following KEGOC services refer to the natural monopoly services:

- electricity transmission via NPG;

- technical dispatching of electricity supply to the grid and electricity consumption;

- management of electricity generation and consumption balancing.

Once established, KEGOC has been consistently improving the tariff policy of regulated services and playing an active role in activities of relevant organisations relating to the tariff policy improvement.

In accordance with the legislation KEGOC shall submit applications to the Committee for Regulation of Natural Monopolies, Protection of Competition and Consumer Rights of the Ministry of National Economy of Kazakhstan (the authorized body regulating natural monopolies) seeking approval (revision) of tariffs for regulated services referring to the sphere of natural monopoly.

The Company’s tariffs are set on a costs-plus basis, whereby the Company, in order to set a tariff for a certain period of time, considers the corresponding estimates of operating and financial costs and a fair rate of return on capital.

In 2013, KEGOC started rendering services at the cap tariffs. The principles of calculating the cap tariffs are similar to the calculation of annual tariffs except that the cap tariffs shall be approved for the period of up to five years. The cap tariffs make it possible for the Company to plan its capacity for long periods, and shareholders have the opportunity to get more information about the Company.

In accordance with the established procedures, KEGOC applied to the authorized body regulating natural monopolies seeking for approval of the cap tariffs and tariff estimates for KEGOC’s regulated services for a long-term period. Based on the consideration results, Order No. 388-OD dated 21 September 2015 approved the cap tariffs and tariff estimates for KEGOC’s regulated services for a five-year period from 01 January 2016 to 31 December 2020.

| tenge per kWh | 2016 | 2017 | 2018 | 2019 | 2020 |

| electricity transmission | 2.080 | 2.246 | 2.496 | 2.823 | 2.797 |

| technical dispatching | 0.231 | 0.234 | 0.249 | 0.306 | 0.306 |

| generation and consumption balancing | 0.084 | 0.086 | 0.091 | 0.098 | 0.098 |

In 2018, the following temporary compensatory tariffs were applied for the regulated services of KEGOC:

| Service (KZT/kWh) | Period | Grounds | Decision | |

| 01/01/2018– 30/06/2018 |

01/07/2018– 31/12/2018 |

Based on the consideration of the report on execution of tariff estimates for 2016 and 2017 |

of the authorized body regulating natural monopolies |

|

| electricity transmission | 2.4957 | 2.4928 | ||

| technical dispatching | 0.2489 | 0.2482 | ||

In addition, the authorized body approved the decision of KEGOC to reduce, from 1 August 2018 to the end of 2018, the cap tariffs for technical dispatch of supply to the grid by 5% (from 0.2482 to 0.237 KZT/kWh), and for managing of electricity production and consumption balancing by 3% (from 0.091 to 0.088 KZT/kWh).

The decision to reduce KEGOC cap tariffs was made in accordance with the current legislation so that to achieve a balance of interests of consumers and the natural monopoly considering the actual growth in the volume of technical dispatching of electricity supply to the grid and managing of electricity production and consumption balancing for the previous period of 2018.

At the end of 2018, as part of the fulfilment of the instructions of the Head of State, the Ministry of Energy of the Republic of Kazakhstan decided to reduce the cost of electricity from 1 January 2019. Considering this decision, and the planned growth in the volume of services provided by KEGOC with the view to support the population, small and medium-sized businesses, the Company decided to reduce tariffs for its services to the level of 2018.

| Service | Approved tariff caps for 2019 (tenge per kWh) |

Tariff caps for 2019, including reduction (tenge per kWh) |

| Electricity transmission | 2.823 | 2.496 |

| Technical dispatching | 0.306 | 0.237 |

| Managing of production and consumption balancing | 0.098 | 0.088 |

According to the approved procedures the Company arranges public hearings to report its activities with respect to regulated services to strengthen the protection of consumers’ rights, ensure transparency of activities for consumers and other interested parties. The basic principles of public hearings are publicity, transparency of the Company’s activities and observance of the balance of consumer interests.

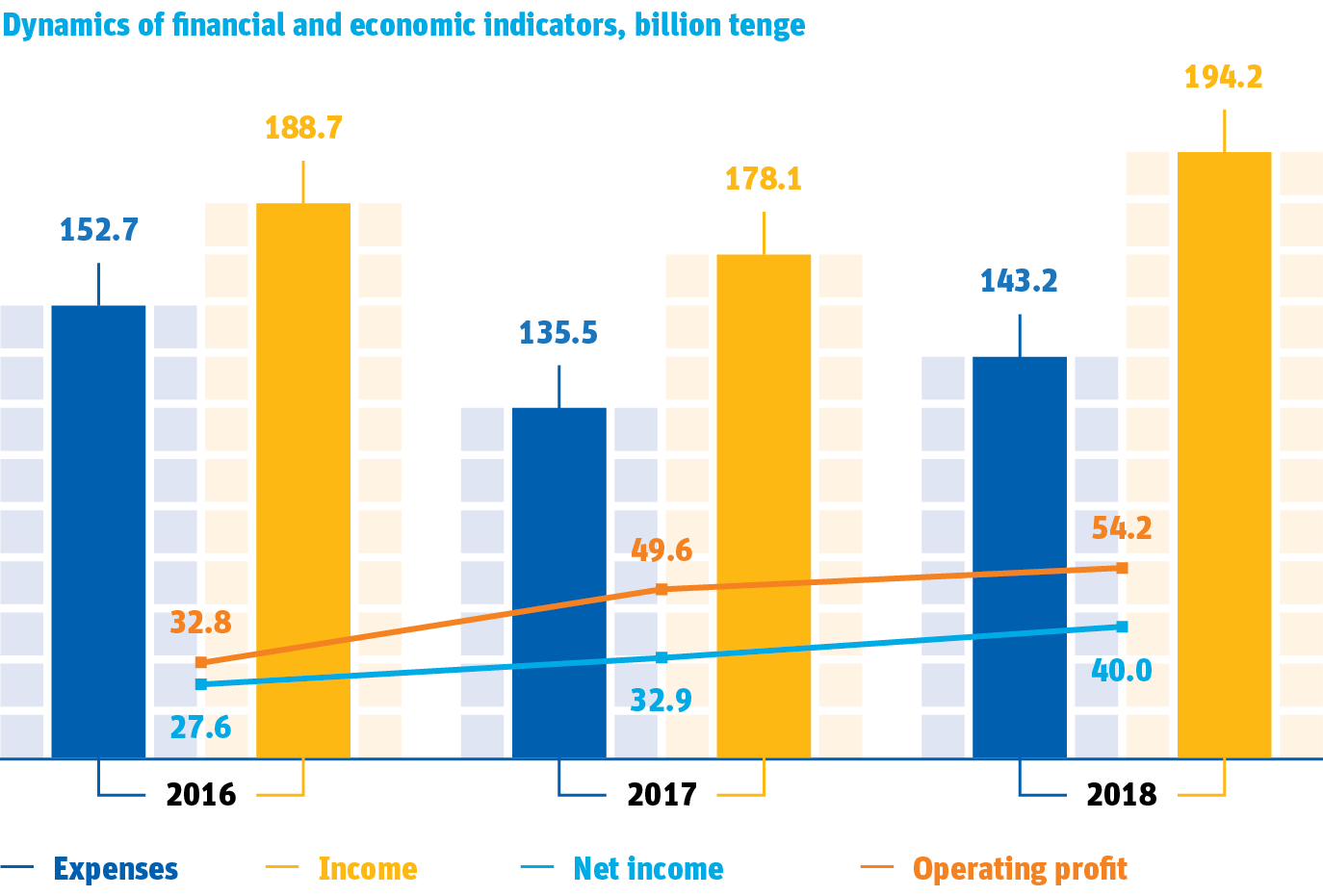

Financial and Economic Performance

The financial and economic results of 2018 were affected by the growth in the volume of rendered regulated services, revaluation of fixed assets classified as Constructions, and the partial early repayment of the borrowed loan at the end of 2017.

Analysis of the implementation of planned income and expenditure indicators, KZT million

| 2018 plan | 2018 actual | Deviation | Main reasons for deviations | |

| Consolidated income | 173,225.15 | 194,194.04 | +12.1% | |

| operating income | 171,268.92 | 175,797.39 | +2.6% | Due to the increase in revenues from regulated services, from the sale of electricity to compensate for hourly deviations of the actual cross-border balance flows. At the same time, the decrease in revenues due to decrease in revenues from the sale of purchased electricity (Uzbekenergo did not purchase electricity), from the sale of purchased electricity produced by renewable energy sources by FSC RES and from the sale of power control services. |

| non-operating income | 1,956.23 | 18,396.65 | The increase is due to the growth in the foreign exchange gain, income from recoverable impairment loss of the fixed assets classified as Construction, income from the interest on bank deposit operations, income from the interest on securities, income due to change in the fair value of short-term securities, and income from equity participation in other organizations (share of profits of associated enterprises). | |

| Consolidated expenditures | 129,259.32 | 143,169.22 | +10.8% | |

| cost of sales | 107,082.58 | 105,840.19 | -1.2% | Due to the reduction of expenses on technical losses, on the purchase of electricity to compensate for non-contractual withdrawal by Uzbekenergo due to the lack of electricity supply, and on power regulation provided by third parties. In addition, there is decrease in labour costs due to the postponement of the introduction of a new procedure for evaluating activities, expenses on labour and environmental protection, on fuel and lubricants, etc. At the same time, expenses on depreciation deductions increased due to the operating system revaluation, purchase of electricity from the Russian power system to compensate for imbalances, transfer of electricity via the third-party networks, purchase of electricity generated by renewable energy sources. |

| 2018 plan | 2018 actual | Deviation | Main reasons for deviations | |

| general and administrative expenses |

16,848.22 | 15,499.09 | -8% | Due to the reduction of expenses on consulting services based on capitalization, on labour costs, on the costs of technical support of information systems of the business transformation centre, on travel expenses, as well as other expenses of the period. At the same time, property tax expenses increased. |

| Consolidated income | 178,134.83 | 194,194.04 | +9.0% | |

| Operating income | 152,379.82 | 175,797.39 | 15.4% | The fulfilment is mainly due to the increase in revenues on regulated services, as well as revenues from operations on the purchase and sale of electric energy by FSC RES. |

| Non-operating income | 25,755.00 | 18,396.65 | -28.6% | Due to the decrease in the foreign exchange gain, decrease of revenues from operations with deposits, from changes in the fair value of long-term trade receivables, from equity participation in other organizations (the share of profits of associated enterprises). At the same time, there is increase in the income from recovered impairment loss of fixed assets classified as Construction, income as interest on securities, changes in the fair value of short-term securities. |

| Consolidated expenditures |

135,493.13 | 143,169.22 | +5.7% | |

| cost of sales | 89,399.37 | 105,840.19 | +18.4% | The excess is due to the increase in expenses for the purchase of electricity produced by renewable energy sources, depreciation deductions due to the revaluation of fixed assets, technical loss of electricity, purchase of electricity from the Russian power system to compensate for imbalances, remuneration of production personnel, transmission of electricity via the third-party networks. |

| general and administrative expenses |

13,142.39 | 15,499.09 | +17.9% | The increase is mainly due to the accrual of provisions, property tax and labour costs. At the same time, the expenses for consulting services and medical insurance for employees deceased. |

All of the above factors influenced the operating profit and financial result based on 2018 results.